According to Investopedia, bootstrapping is “A situation in which an entrepreneur starts a company with little capital. An individual is said to be bootstrapping when he or she attempts to fund and build a company from personal finances or from the operating revenue of the new company.” For example, when I started my first company, I used the Family, Friends, and Fools (FFF) method of financing. I used $100,000 of my own money along with another $50,000 from my family and any fool crazy enough to give me their money to fund my company.

So, let’s talk about some of the advantages and disadvantages of bootstrapping a start-up.

Advantages and Disadvantages:

CONTROL

When financing a start-up not through conventional means like a bank, but through unconventional means like joining an accelerator, venture capital, strategic partners, or angel investors, you must give up your precious equity in the company. It is important to remember that each one of these alternative financing arms have their own motivations, goals, and interests when they choose to invest in your start-up.

Time and time again, I’ve seen clients who gave an alternative financing institution a large part of equity in their company for little support and direction in return. Their interests are not necessarily the same, and then the clash begins. It can be particularly challenging trying to navigate these outside pressures.

By self-funding or funding through Family, Friends, or Fools (FFF), you get to answer to yourself only. This allows you the freedom to lead as you wish, set your own agenda, and most of all, keep the equity in your company. However, there are some downfalls to this.

Have you ever heard the saying “It’s not what you know, but who you know?” That is a very accurate statement when it comes to start-ups. Alternative funding sources are usually full of connections that you do not have access to. They will help you get meetings with the right people, connect you with valuable partnerships, open up markets, and give you increased visibility that you would otherwise not normally have. Lacking these connections, you’re on your own in many ways to find and build support, knowledge, networking, and financing.

As I tell my students, “It’s good to be young, because you can bounce back.” But what about the credibility you need to get to the right people? Not having outside investors may hurt your company’s credibility in the beginning. The question I always ask before I invest in a start-up is, “What kind of experience do these people have in running a business. How well do they listen, and who are their mentors?”

While bootstrapping gives you complete control over your company, self-funding may also shine a light on your company’s lack of resources and business experience. On the other hand, being supported by well-respected and credible investors gives many potential customers the confidence to buy in.

EQUITY

Not having investors allows you to keep 100% of your company. If you become a success through bootstrapping, at a later date you can seek additional funding for a much larger pie and do so on your terms. This means you can negotiate a smaller equity investment than you would negotiating while you are a start-up, because the investor has to take less risk when you come to them at a later stage of the company’s growth.

When bootstrapping, you tend to gain a lot more from your company if it becomes successful, but you will also lose much more if it doesn’t. Remember that the losses will be absorbed by you. Having an investor does allow you access to much-needed cash, but at a price: equity of your company. However, along with that much-needed cash comes a lot of experience, mentorship, and a strategic partnership that will help your company grow at a much faster rate with less mistakes—if you choose the right investment partner. Bootstrapping is risk-taking; you stand to gain a lot more if your company is a success, but if it’s not, all that loss is yours and yours alone.

TIME

Organic development is very time-consuming. When I started Credit Justice Services, it took us three years to get traction. Once the traction hit, however, our expansion was crazy. Yet, if we were to have an investor in the beginning, the growth would have been much faster. Without a large amount of cash on hand, the company would not be able to develop key components as quickly as we desired.

A certain amount of revenue is always required for expansion, research and development (R&D), employees, and marketing. This can happen at an accelerated rate with access to a capital investor. Without that access, some growth milestones will take longer to reach, and targets might have to be pushed further down the line.

In my experience bootstrapping my companies, time was usually a large obstacle I had to overcome. For the first three companies I started, built, and sold, I did so as a full-time airline pilot. I was fortunate that I had a schedule that allowed me 15 days off a month. That’s not common for most people, so they’re left with a minimal amount of time to devote to the start-up, especially if they have other obligations in their lives. This leads to the project taking a longer period of time to execute—sometimes years.

Start-Ups Should Learn the Following Before Proceeding:

- Is it better to have control over your business, but slower growth?

Money helps fuel growth. Money allows you to expand your employee base, market, advertise, and do R&D for a more rapid expansion in a shorter time period.

Bootstrapping means you may not have significant resources to draw on and you will need to dial back your costs. You might even need to keep your full-time job while you launch your business, which will slow down your growth process.

So, the question to ask is, “Can I accept that my start-up’s growth will likely be slower?” But remember, in return, you’ll maintain complete control over your business and its profits.

- Can you partner with an existing company to expedite growth (i.e., distribution, vendors, manufacturers)?

Finding the right partner can be tricky; believe me when I say a bad partner is worse than a bad marriage. So, try to team up with vendors. For example, I would go to my wholesale manufacturer and ask for generous payment terms, sometimes as much as a three months payment plan. This will allow you to start your business without investing in inventory. A service provider may offer to finance inventory in exchange for performing other jobs for you, like equipment sales or a maintenance contract.

This enables you to keep the equity in your company, not take on an equity partner, and keep much-needed cash on hand.

- Do you need capital to test your idea? Customer Discovery first may show you don’t.

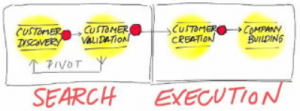

Customer Discovery determines if there is a want or need for your product/service.

Here are a few ways to validate your idea that don’t involve significant investment (these methods are expanded upon in depth in my previous articles):

- Customer Discovery – Find the pain points of the customer. Learn as much as possible about their needs and wants.

- Customer Validation – Go back to the customer with a Minimal Viable Product (MVP) and confirm the customers pains and gains.

- Customer Creations – Get-Keep-Grow your customer base by using the funnel method.

- Company Building – This is very important and the most cash-bleeding part of the four-step process, so be sure to hire slowly, deliberate, and conserve cash.

- Can I afford to risk financial/emotional failure?

Creating a start-up will be the biggest emotional roller coaster you will ever get on. Dealing with government regulations, taxes, employees, vendors, and customers is at times like living in a pressure cooker.

You will experience setbacks, roadblocks, and naysayers, which are all amplified when you have limited money to throw at these problems. The only way to overcome this is by pure grit and creativity, but it can also be incredibly rewarding when it works and you watch your business grow! So, should you bootstrap your company?

If you’d like more information, please feel to contact me directly at dmuir@muirandassociates.net or go to my academic web site for more white papers and research at https://douglasmuir.academia.edu/